These are the summary results of the new WindEnergy trend:index (WEtix) which has been compiled at six-month intervals since 2018. It is published jointly by WindEnergy Hamburg, the global onshore and offshore wind energy event, and wind:research, the leading market research institute for wind energy. More than 800 respondents took part in the current survey, contributing their assessments of the development of the global onshore and offshore wind industry. All in all, more than 10,000 experts have participated in WEtix surveys since 2018. The survey covers all onshore and offshore regions globally. The pre-defined market regions include Germany, Europe (including Germany), North America, Asia and Rest of World (RoW), comprising Africa, Australia as well as Central and South America.

Mood has dimmed slightly across all regions but remains positive

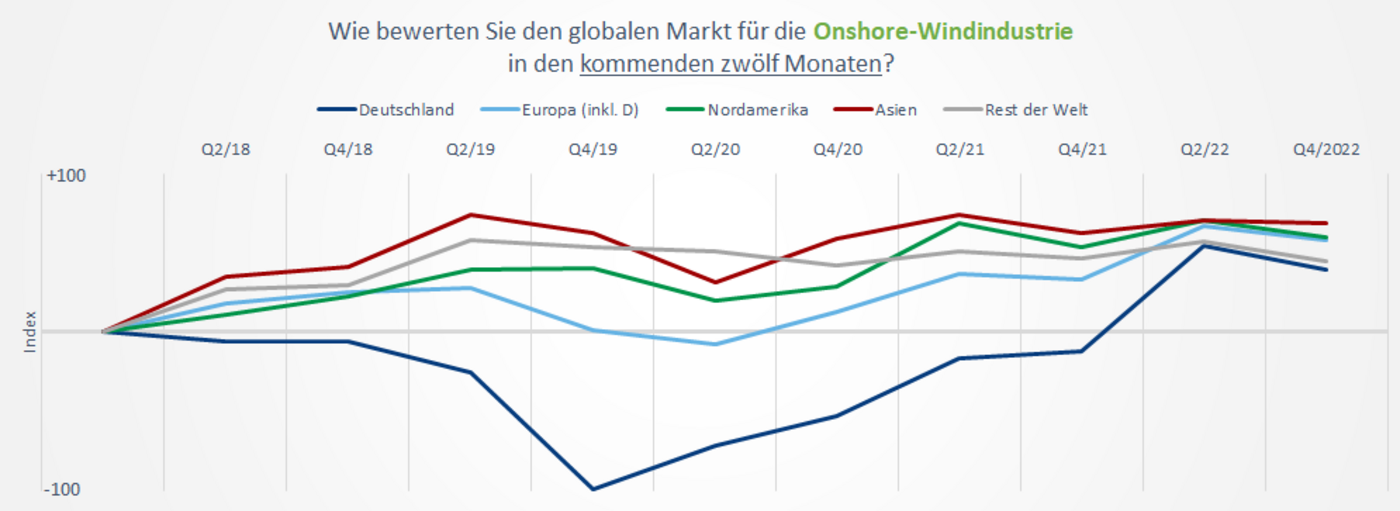

Not much has changed since the last edition of the WEtix survey in spring of 2022, compared to the sometimes dramatic changes observed in previous years. The picture is similar across all regions, time periods and industry segments: the high, consistently positive assessment level achieved in the previous year persists or has declined only slightly. The mood in Germany, having experienced a steady rise since the second survey of 2019, has now come to a first halt. While it does not fully reach the record level of the previous WEtix, it remains very high when compared to the entire period covered by WEtix surveys, and is close to the other regions. The results for the remaining regions are quite consistent, as well. As noted for the previous survey, all regions are approximating each other. Assessments of the economic conditions and the mood in the markets achieve values in the medium or even high range across all regions.

Trends are similar for nearly all other regions: Following several WEtix surveys indicating an improving, or at least, a consistently high mood level, the present survey reflects a certain decrease, if marginal in some cases. While the offshore segment again receives more optimistic ratings, the differences are shrinking.

High relevance of education and training programmes; concern about supply chain disruption

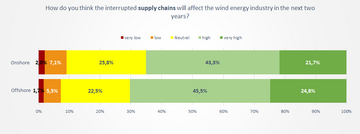

While the situation of the wind industry is, by and large, seen in a positive light, market stakeholders express some concerns. For the first time this WEtix included a question regarding the importance of education and training for the wind industry. The results speak a clear language: two thirds of respondents assign great importance to this topic, a fact that obviously reflects the lack of skilled labour. Similarly, two thirds of respondents see a strong impact of disrupted or obstructed supply chains on the industry. This is an expression of experts’ concerns about current geopolitical events, including the coronavirus pandemic. Survey responses about the effects of the Ukraine war, on the other hand, are surprisingly neutral in this WEtix. The number of respondents expecting a positive impact roughly matches those expecting negative consequences – a result that is contrary to the answers given in the previous edition where a majority predicted a negative impact.

An equally noteworthy result of this survey is the significantly lower importance assigned to the production of green hydrogen. For the first time in two years, (significantly) less than 50 per cent of respondents are convinced that hydrogen production will play a major role. On the other hand, responses about saving potential enabled by new technologies are much more optimistic this time. After this question had received positive ratings very consistently over the past years, there is now a new dynamic, with higher expectations for saving potential expressed for both, the offshore and onshore segments, especially for the latter.

Contact for questions regarding content, interpretation and methodology as well as wind:research:

Dirk Briese, ph. +49 (0)421-43730-0, presse@windresearch.de

About wind:research:

The market research institute wind:research prepares market studies and analyses as well as expert reports, through to M&A services for the wind energy sector, delivering detailed insights for strategy development to energy utilities, project developers, operators, component and turbine manufacturers as well as municipal, state and federal governments.In addition, it publishes weekly clippings on a wide range of topics such as hydrogen. For further information please visit: www.windresearch.de

About WEtix:

The WindEnergy trend:index, a mood barometer for the wind industry, is jointly compiled by WindEnergy Hamburg, the world’s leading expo for onshore and offshore wind energy, and wind:research, the leading wind energy market research institute. The survey focuses on examining the potential of wind energy, covering both the onshore and offshore segments.

About the survey:

Around 14 per cent of respondents work in the offshore segment exclusively and roughly 36 per cent are primarily active in the onshore segment. About 43 per cent are involved in both the onshore and offshore segments.

40 per cent of respondents work in operation and maintenance. Furthermore, around 37 per cent are active in manufacturing as well as planning and project development, and roughly one fifth perform installation-related work.

Activities within manufacturing – by far the most prominent sector, accounting for significantly more than 50 % – are mostly focused on production of turbines and rotor blades.

About 67 per cent of respondents do business in Germany primarily, and around 71 per cent are focused on Europe. 35 per cent each are active in North America and Asia, and 26 per cent in RoW.

More than one third of survey participants hold positions in business, corporate or operations management, followed by respondents from sales, R&D and design as well as maintenance and service.