These are summary results of the new WindEnergy trend:index (WEtix) which has been compiled and published at six-month intervals since 2018. It is published jointly by WindEnergy Hamburg, the global onshore and offshore wind energy event, and wind:research, the leading market research institute for wind energy. More than 500 respondents took part in the current survey between mid-March and end of April 2023, contributing their assessments of the development of the global onshore and offshore wind industry. All in all, more than 10,000 experts have participated in WEtix surveys since 2018. The survey covers all onshore and offshore regions globally. The pre-defined market regions include Germany, Europe (including Germany), North America, Asia and Rest of World (RoW), comprising Africa, Australia as well as Central and South America.

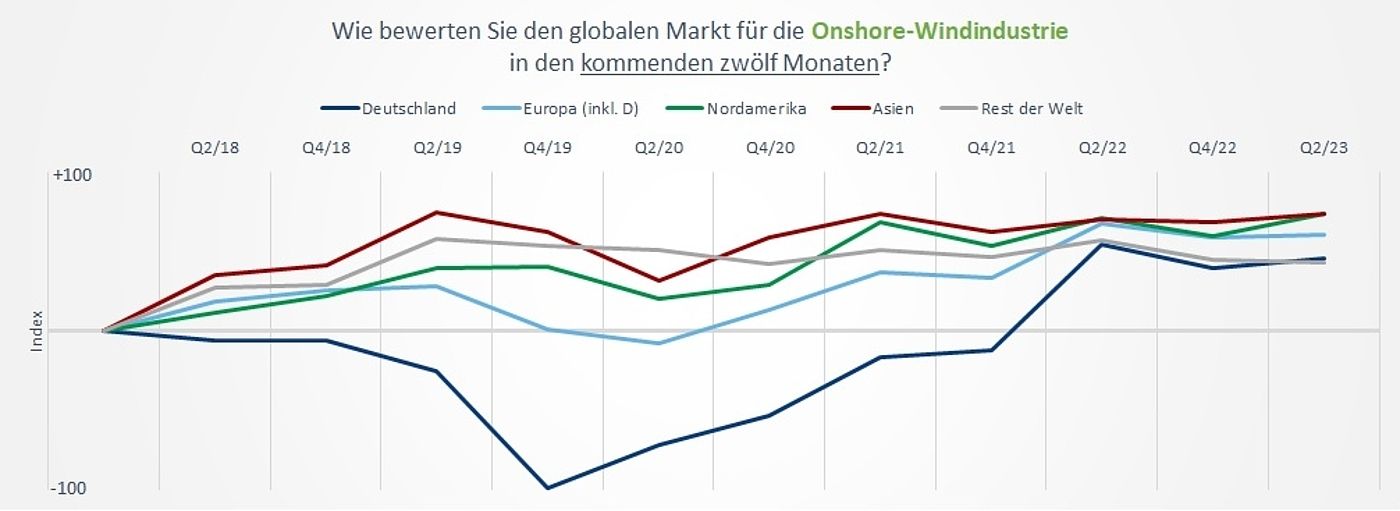

Mood has dimmed slightly across all regions but remains positive

The changes observed since the last edition of the WEtix survey in autumn 2023 are relatively minor compared to the sometimes dramatic changes in previous years. Assessments of the global markets remain quite positive and the mood is generally good for both onshore and offshore wind. In a short-term retrospective especially, all markets are showing improvements. The mood in Germany, having improved steadily from the third quarter of 2019 until the first half of 2022, is stagnating on a very high level compared to earlier years.

The overall mood remains positive: There is no industry segment, time period or region where the mood is declining into the negative quadrant; in the context of all WEtix trend surveys conducted so far, most ratings are still in the medium to upper range. Short-term developments have improved in both, Asia and North America, with both regions maintaining very high levels.

The general conditions for wind energy again received mostly positive assessments. Compared to the previous six-month survey period, some of the assessments are now trending upwards, with only Europe and the rest of the world declining slightly.

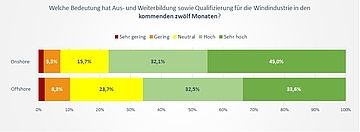

High relevance of education and training programmes; concerns about supply chain disruption

While the situation of the wind industry is, by and large, seen in a positive light, the market stakeholders are expressing some concerns. This WEtix again included a question regarding the importance of education and training for the wind industry. The results speak for themselves: This WEtix again reflects wide-spread concerns regarding the availability of skilled labour. More than 66 % of respondents assign high or very high importance to the availability of education and training programmes for wind energy.

After the last issue of this report signalled an end to the period of stagnation in the assessments of saving potential, the latest survey hardly shows a change of opinions.

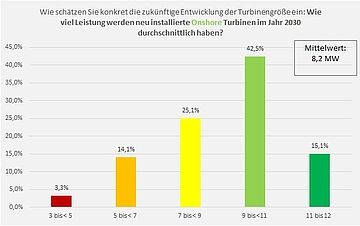

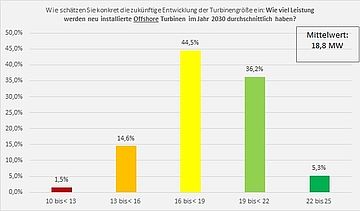

The question about turbine sizes and power output expected for 2030 for both the onshore and offshore segments, included in this WEtix survey for the first time, addresses the potential for further technological progress. For both segments, respondents expressed expectations of a more or less significant increase of turbine output power, notwithstanding the general opinion voiced by industry experts that growth is finite. This is attributable to hopes that turbine manufacturers will finally enter the profitable zone, which is a necessity in the long term. An average size of 18.8 MW for offshore, and 8.2 MW for onshore turbines would represent an additional significant increase.

About wind:research:

The market research institute wind:research prepares market studies and analyses as well as expert reports, through to M&A services for the wind energy sector, delivering detailed insights for strategy development to energy utilities, project developers, operators, component and turbine manufacturers as well as municipal, state and federal governments.In addition, it publishes weekly clippings on a wide range of topics such as hydrogen. For further information please visit: www.windresearch.de

Contact for questions regarding content, interpretation and methodology as well as wind:research:

Dirk Briese, ph. +49 (0)421-43730-0, presse(at)windresearch(dot)de

About WEtix:

The WindEnergy trend:index, a mood barometer for the wind industry, is jointly compiled by WindEnergy Hamburg, the world’s leading expo for onshore and offshore wind energy, and wind:research, the leading wind energy market research institute. The survey focuses on examining the potential of wind energy, covering both the onshore and offshore segments.

About the survey:

Around 15 per cent of respondents work in the offshore segment exclusively and roughly 40 per cent are primarily active in the onshore segment. About 38 per cent are involved in both the onshore and offshore segments. 38 per cent of respondents work in operation and maintenance. Furthermore, around 52 per cent are active in manufacturing, 42 per cent work in planning and project development, and roughly 17 per cent perform installation-related work.